The cost of renting a home

The costs of running your own home

Before you bid for a property are you sure you can afford to have your own home?

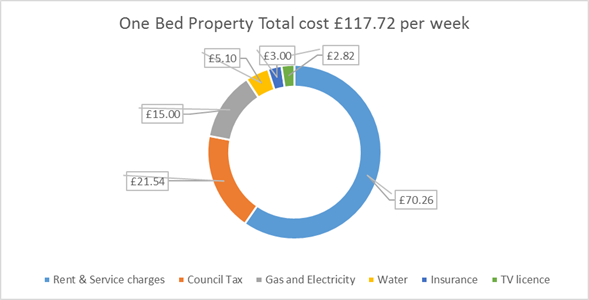

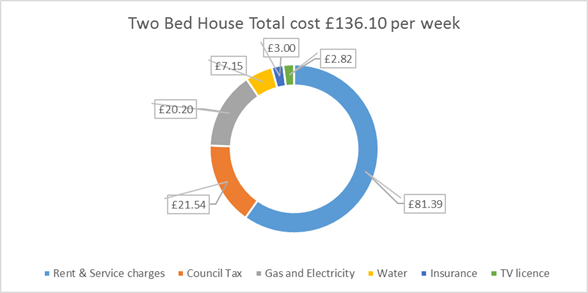

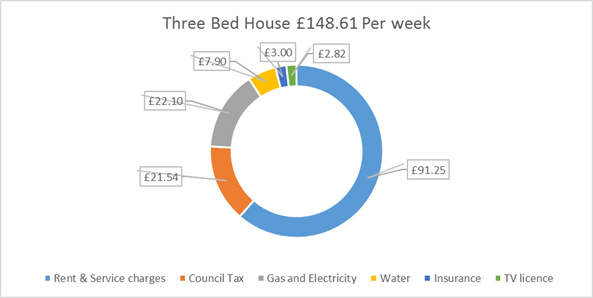

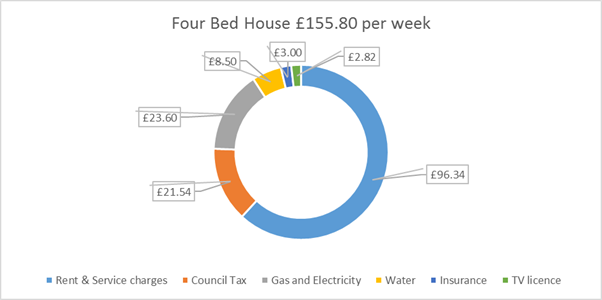

This guide is to give you an idea of the typical cost of living in your own home, it is based on the average rents for a local CBL partner Landlord.

The council tax is an average for the Band A across Merseyside.

These costs do not include the cost of Food, clothes and shoes, phones, socialising, any existing debts (catalogues) and any travel costs.

Weekly cost will rise if you decide to have a mobile phone contract and you smoke and/or enjoy socialising with friends and family.

We recommend that you think carefully before taking on your own home, can you really afford to pay your bills and have money left to live on?

Even if you are entitled to Benefits to cover the cost of your Rent and Council Tax, it’s still expensive to live in your own home.

There are lots of websites to give you advice on these matters:

https://www.moneyadviceservice.org.uk/en/articles/paying-your-own-way

https://www.gov.uk/benefits-calculators

https://www.moneysavingexpert.com/mortgages/rent-a-property

Some other costs to think about:

Food for 1 person minimum £15.00 per week (based on very basic diet)

Clothes for 1 person minimum £5.00 per week (spread across the year again very basic essentials)

Do you smoke?

Birthday and Christmas presents for family & friends

Do you have a mobile phone contract?

Broadband contract

Travel costs, do you need to travel to visit family, attend GP/hospital appointments or attend college?

Do you have children, children’s nappies, food & toiletries can be very expensive?

Hairdressers